For three straight years, we were told by our customers at Horsefly Analytics that we need ethnicity insights that will allow us to make meaningful changes.

People in Talent Intelligence, Talent Acquisition, EDI and HR roles acknowledged that diversity is essential, and they genuinely wanted to make changes which weren’t tick box exercises.

I remember speaking to a senior leader at a big corporation who said 90% of the diversity work we are doing is not based on any factual evidence.

At Horsefly, we are in the business of providing facts, and we thought we could make a valuable contribution to diversity efforts. So we spoke to many people, including the great Bill Boorman, whom I greatly admire for his ability to learn deeply about HR issues. His perspective on acknowledging/defining a complicated problem and finding a solution is invaluable.

We also spoke to Derek Appau, a thought leader around the EDI problems brought to the fore over the past two years. His understanding gave us insight into issues that existed much earlier than others.

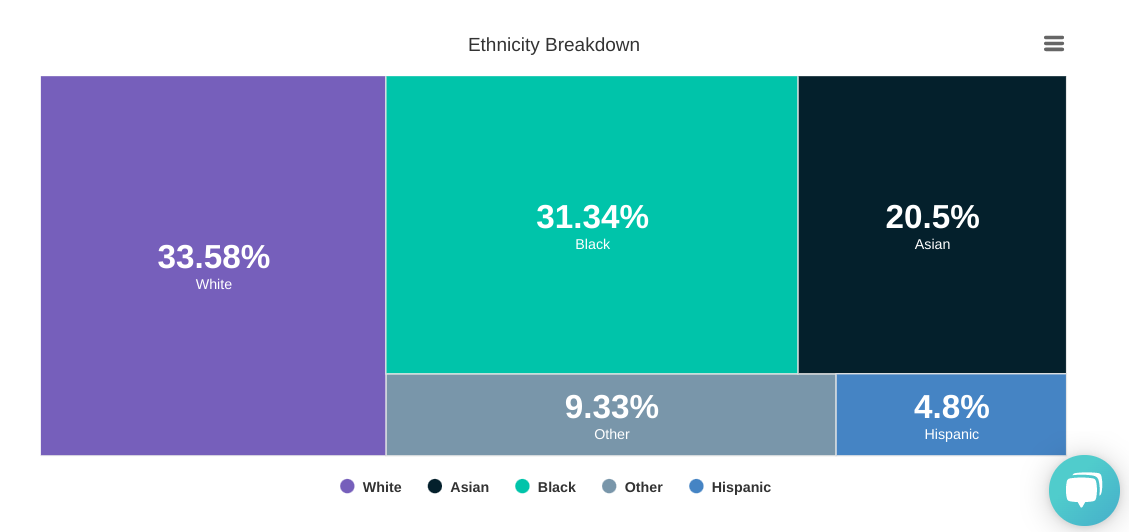

There’s a broader discussion around diversity, but for now I’m interested in how Horsefly can provide insights to solve problems for people in HR, Talent Intelligence, Talent Acquisition, and EDI. Since our December 2021 release of ethnicity data, we have had at least twenty solid use-cases, some we didn’t even think of; the top three are:

- Setting realistic ethnicity hiring goals.

- Every business should look to achieve this by setting challenging but achievable EDI targets based on a deep analysis of the available target talent and location.

- Diversity of thought is important, and having a diverse employee population has proven to provide this. If you have five white males over 40 in a room, you will miss many perspectives. If you have five black females under 30, you will also miss various perspectives. The reality is there are multiple ways to think about a problem. A mixture of ideas is always more effective.

- Optimising location-based hiring to achieve EDI goals.

- Clients want to make more effective location-based hiring decisions not just based on job titles and availability of talent but by targeting locations with a greater balance of targeted ethnic groups.

For example, a Talent Intelligence team might want to develop a go-to-market strategy to identify locations with a higher percentage of Asian Financial Managers with experience in Credit Risk. By searching for Financial Manager AND “Credit Risk” across multiple countries, you can identify at macro and micro levels which countries, towns/cities will likely give you the best chance of addressing an EDI goal for a specific ethnic group.

- Clients want to make more effective location-based hiring decisions not just based on job titles and availability of talent but by targeting locations with a greater balance of targeted ethnic groups.

- Assessing your existing workforce to the external market

- Without a baseline, how can you assess your current EDI performance? Comparing to the external market can provide you with a valuable “health check” to determine how you are currently performing.

However, we face some problems with ethnicity data.

Granularity

To make meaningful decisions, you need accurate, granular results, literally insights at the level of “Java Developer” AND (“Hadoop” OR “ElasticSearch” OR “Solr”) within 15 miles of Paris. In the absence of granular data, you have no other choice than to stick to high-level government datasets of, at best, Occupational Codes e.g.

And at worst industry sector, which tells you nothing meaningful about your employees or talent markets.

Global Data and Normalisation

To understand different countries, opportunities, and ethnic makeup, it’s essential to compare apples with apples. Government datasets, which are so important as a layer of our probability score, are so disparate across different countries that it’s impossible to simply access a country's demographic API and compare it to another as no two datasets are the same.

I think we’re getting closer to normalised global data sources, but for the moment, it’s complicated!

Government data is only a single data layer which makes up our ethnicity product. A similar normalisation process was applied to our other data sources, including social profiles, market segmentation and localised geographical demographics, which, when coupled with our algorithm, gives us a complete picture of the ethnicity make-up of a group of profiles.

Leadership Buy-in and Tick box Exercises

Horsefly has been first to market on two occasions, and each time it’s been difficult, the first was comprehensive, granular labour market insights in the UK, supply, demand, and average salaries. We spent our first year educating the market on using this type of data, and we learnt some important lessons.

Arriving first to market with granular, global DEI data feels more meaningful and mainstream. We designed the product in one year and spent 2.5 years achieving an accuracy level of over 85% by stringently testing against many generous partners who shared their internal data and allowed us to test the accuracy of our algorithms.

Why am I telling you all this? Leadership buy IBM products for a reason, they’re the brand leader, you know you’re getting a quality product. You need a clear plan with proven, measurable metrics to influence your leadership team.

Working directly with leadership teams at some of our current global partners including Jaguar Land Rover, Kornferry, Hays, Astra Zeneca, Defra, HMRC and Lloyds Banking Group, specifically around our ethnicity product, gave us so much confidence that organisations across the globe want to move away from EDI tickbox exercises, at high cost and expense, to achieve real, tangible, measurable change.

It made us happy.